What is an Employee Cash Advance Account?

An Employee Cash Advance account is used to track the funds that you pay to an employee to cover travel expenses or early paycheck withdraws.

In QuickBooks Online, you can use the other current asset account to keep track of the initial check that is written to the employee.

You can also record the expenses once the employee submits an expense report detailing how they spent the cash for travel expenses and/or reduce their paychecks for the balance.

Keep reading to learn how to record a non-payroll-related employee cash advance in QuickBooks Online.

To get started, log into your QuickBooks Online file and follow the below steps. In my example below, I am specifically showing how to record a non-payroll employee cash advance.

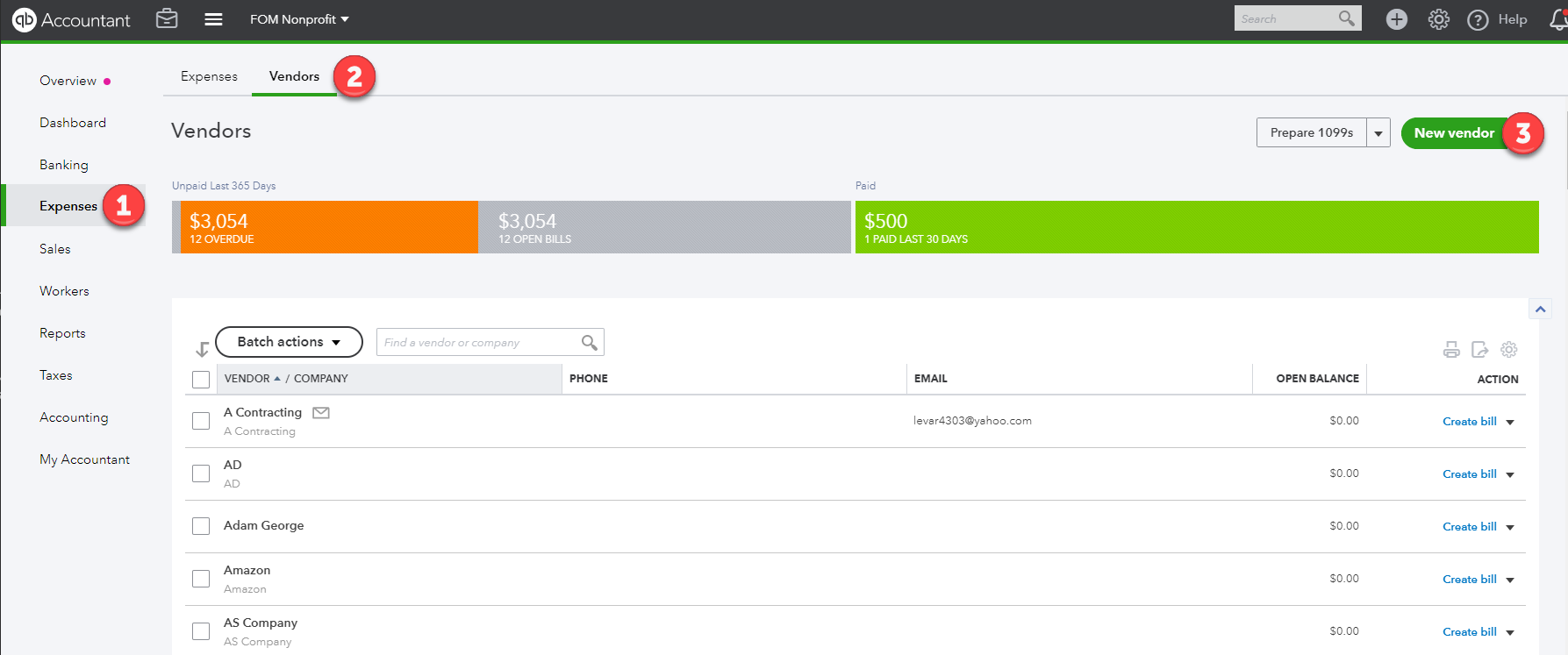

Create your Employee as a Vendor

Click the Expenses tab at the left navigation bar, then select Vendors

Click the New vendor green button to create your employee as a vendor if they don't already exist in your vendor center

In the vendor information screen, enter the following:

First and last name of employee and add in the suffix box

Uncheck the box next to print on check as display name, then enter the employee's name without suffix

Complete the address field, email address, and other details

Add a note stating this account is strictly used to record "employee reimbursements and cash advances"

Click save

PRO TIP: Only add the suffix to the employee's name if you are already using the employee center in QBO to process payroll for your business.

Create an Employee Cash Advance Account & A Clearing "Bank Type" Account

Click on the Accounting tab at the left navigation bar, then select the Chart of Accounts

Click the New green button to create a new account

In the account edit window, make the following changes:

Account type = Other Current Assets

Detail type = Employee Cash Advances

Name = Employee Cash Advances

Number = Add an account number

Description = Describe the purpose of the account (optional, but highly recommended)

Leave the balance fields empty

Click the Save and Close green button to create the account

Repeat the same steps above to create a bank type clearing account if you don't already have one listed in your chart of accounts. I created my own bank type account as a petty cash account.

Write a Check to Employee for Cash Advance

Click the Quick Create (+) icon, select Check under the Vendors column

In the Check window, do the following:

Payee's name = Employee's name (choose the vendor option)

Bank Account = Petty Cash account or a Clearing account

Payment Date = Expense report submission date

Ref No = Check number or bank reference number if doing ACH

Division = Location tracking

Category = Employee cash advances account

Description = [Employee name] Cash Advance

Enter an amount

Enter a customer/project if applicable

Enter a class

Copy and paste the above description field text in the memo field

Add any applicable attachment like your advance payment request form

Click Save and Close

PRO TIP: Don't forget to remind your employee to submit an expense report with supporting documentation for how the cash was spent.

Record the Expense to Reduce The Employee Cash Advance Account Balance

For this process, you will need a copy of the expense report from the employee and need to use the petty cash or clearing account we created above.

To record the expense transactions, we are going to do a zero-sum transaction using an expense form instead of a journal entry.

Create a Zero-Sum Expense

Click the Quick Create (+) icon, select Expense, or Check under the Vendors column

Enter the same vendor's name (aka your employee) from the prior step

Payment account = Petty cash account or Clearing account

Payment date = Expense report submission date

Payment method = Cash

Reference no = Employee's abbreviated name and expense report submission date (ex. JD20190602)

Location Label = Select from the dropdown option your location name

Category = expense account for each transaction listed on the employee’s expense report

Description = purpose of the transaction

Enter an amount, customer/project if applicable, and a class

Repeat all of the above for any additional expenses from the expense report

In the final line, do the following:

Category = Employee cash advances account

Description = "Reduce [employee's name] cash advance balance for expense purpose"

Amount = Enter the expense report total as a negative amount

Select a class

Repeat the last line memo and attach the expense report in the attachment field

Verify that you expense form total says $0

Click Save and Close

Run the Employee Cash Advances Report to Verify Your Work

Click on the Accounting tab, then select the Chart of Accounts

Scroll down or use the search bar to find the Employee Cash Advances account, then click run report using the dropdown triangle next to view register

In the below screenshot, you can see the expense and check transactions we entered from above in the report. You will notice that the total balance for the employee is now zero.

PRO TIP: You can customize this report to group by vendor and use the save customization green button to save the report for future use.

Summary

Now you know how to track a non-payroll related employee cash advance in QuickBooks Online using an expense form and how to record an employee’s expense report transactions.

If you don't want to keep having to write checks to your employees for travel expenses, I highly recommend giving your employees a virtual business credit card using Divvy and establishing an IRS accountable plan in place. Check out the best credit cards to use for your business.

Questions about using QuickBooks Online run your nonprofit or small business? Contact Ufuoma - I am happy to help!